Nailing your pricing is a critical aspect of finding e-commerce success.

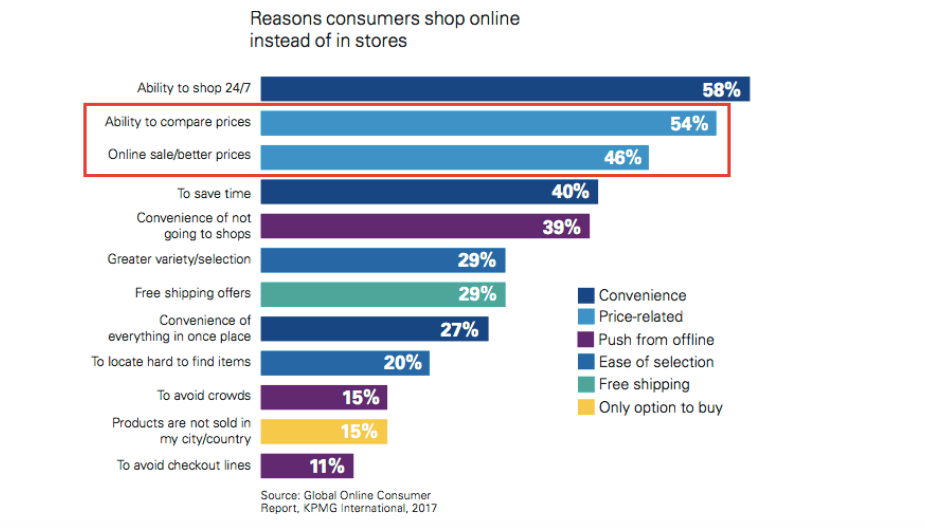

Fifty-four percent of consumers say the ability to compare prices is the main reason they shop online rather than in stores. Further, 46 percent say it’s the sales/better prices they can find that motivate them.

So it’s clear that online shoppers are looking for good prices and having a winning pricing strategy is extremely important.

And while it may look easy on paper, there’s a lot that goes into this process.

After all, you want to price a product high enough that it’s profitable, but you don’t want to go so high that it hurts your conversions.

In this post, I’ll explain the nuts and bolts of e-commerce pricing and provide a simple formula on how to price a product to entice online shoppers. That way, you can optimize your product pricing, increase conversions, boost profitability, and stay ahead of the competition.

So let’s jump right in.

In This Post

Step 1. Calculate Your Per-Product Cost

Step 2. Determine Your Desired Profit Margin

Step 3. Analyze Key Competitors

Step 1. Calculate Your Per-Product Cost

Let me preface this by saying there are several different pricing strategies out there, such as cost-based pricing, value-based pricing, market-oriented pricing, consumer-oriented pricing, psychological pricing, and so on.

And they all have the potential to work depending on the particular situation.

For a quick rundown of common pricing strategies, I recommend checking out this article from Competera, an algorithmic price predictions platform.

It will fill you in on the basics and get you up to speed.

With that said, in this post, my goal is to provide you with a simple formula on how to price a product to serve as an overarching guide.

So the first thing you need to do is calculate your total per-product cost.

Some common factors that contribute to this include:

- Cost of goods sold

- Production time

- Packaging materials

- Shipping and handling

Figure out exactly how much you’re spending on each of these areas to calculate your total per-product cost.

Here’s an example.

Say you spend:

- $29 on the cost of goods sold

- $3 on production time

- $2.15 on packaging materials

- $4.50 on shipping and handling

That would be a total of $38.65.

The sales channel should also be taken into consideration.

If you’re strictly selling on your own website, you would likely charge more than if you were featuring your products on Amazon.

Besides that, you’ll also need to factor in overhead costs like:

- Product storage

- Employee salaries

- Rent and utilities

These can vary significantly and won’t typically be as high for e-commerce businesses as they are for brick-and-mortars.

However, they can definitely increase your total per-product cost and need to be considered.

Step 2. Determine Your Desired Profit Margin

Now it’s time to figure out how much you want your profit margin to be, as this will dictate your ultimate price.

This will largely depend upon your industry and what you’re selling.

“Most e-commerce businesses operate with a gross margin of 20 to 50 percent,” explains PracticalEcommerce. “That range may be greater depending on how you price individual products, what your overall product mix is, what your sales channels are, what you pay for individual products, and other factors.”

However, e-commerce analytics platform Glew reports that e-commerce brands had an average profit margin of 40 percent in 2016.

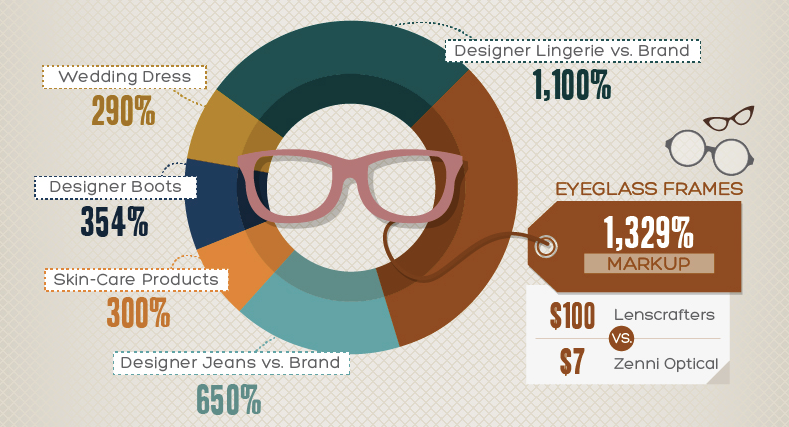

But you should also note that the margins on some products are ridiculously high.

Take skincare products, for example. They have an average 300 percent markup.

Designer jeans are even higher at 650 percent.

And designer lingerie is higher yet at a staggering 1,100 percent markup.

This shows just how big of a disparity there can be.

So I recommend thoroughly researching the average profit margin in your industry to figure out what the norm is and basing your expectations off of that.

The key to choosing the right profit margin is to aim for a number that allows you to stay profitable and maximize revenue but not go so high that it turns off consumers.

There are several variables at play that will determine exactly how much a customer is willing to spend, with one of the biggest being how much key competitors are charging.

And this brings me to my next point.

Step 3. Analyze Key Competitors

Generally speaking, you won’t want to charge any more than twice what your key competitors are charging.

Once you go above that, you’re exceeding what’s considered acceptable, and your sales are likely to suffer as a result.

So it’s important to perform some preliminary research to see what the norm is.

Here’s an example of how this would go down.

Say you’re an e-commerce store owner who is selling pocket hammocks—the ones that can be wadded up and stored in a small bag for convenient transport.

You would want to do some reconnaissance by checking out at least a handful of other companies who also sell pocket hammocks and look at their pricing.

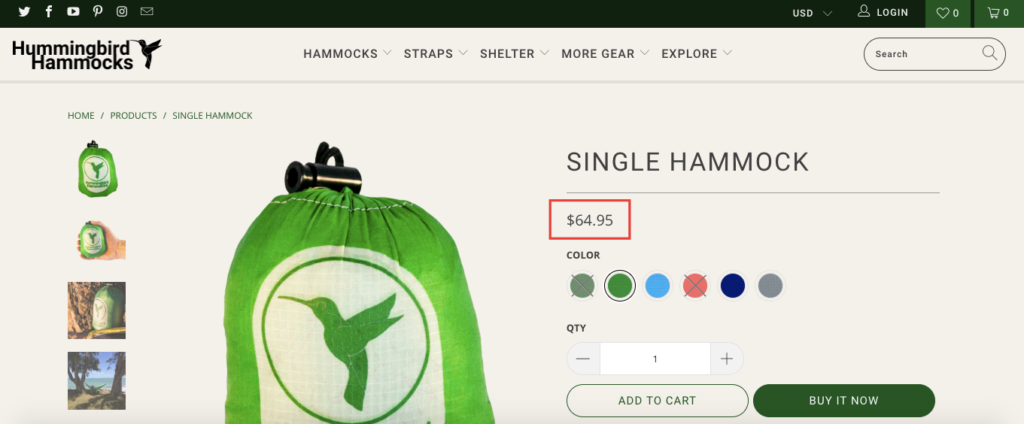

For example, this one from Hummingbird Hammocks costs $64.95.

This one from Madera Outdoor Company is $69.95.

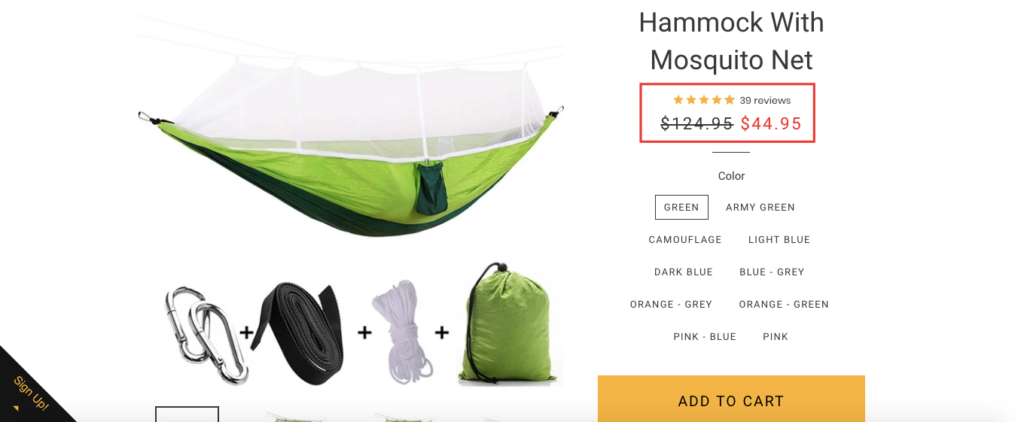

And this one from Outdoor Pocket costs $44.95.

Considering the most expensive pocket hammock from Madera Outdoor Company was $69.95, the absolute most you would want to charge would be double that at $139.90.

However, you would probably run into difficulty making sales if you went above $100 unless your product had a clear differentiator like being made out of super high-quality materials.

The bottom line here is that you’ll want to perform extensive competitor research to get a baseline reading and determine what’s reasonable.

Step 4. Consider Using a Competitor Price Monitoring Tool

Doing basic competitor pricing analysis is pretty straightforward.

You visit the websites of your competitors and see how much they’re currently charging.

But you can take it one step further by using a competitor price monitoring tool to gain detailed insights.

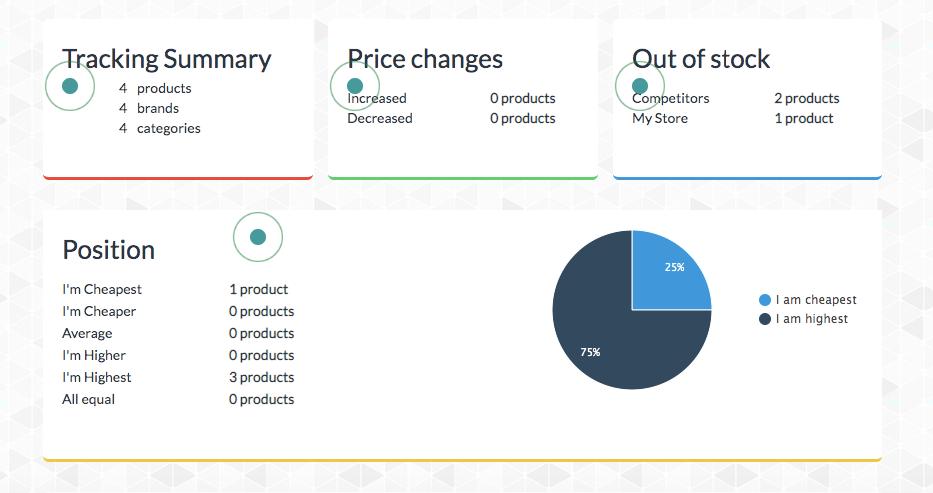

One of my favorites is Prisync—“the pricing software that helps you listen to your competition, optimize prices, and maximize revenue from a single dashboard, easily.”

Not only will this give you access to pricing data on an unlimited number of competitors, but it also allows you to track pricing movements and keep an eye on historical trends from a centralized dashboard.

So any time one of your competitor’s prices changes, you’ll receive a notification in real-time.

This is important because competitor pricing isn’t static.

It’s dynamic and ever-changing, so the information you find today may be completely different a few months from now.

Utilizing a competitor price monitoring tool ensures you always know what’s happening so you can tweak your prices accordingly to maximize revenue.

Although it’s certainly not mandatory, a tool like this can be a huge help in the long run.

Step 5. Factor in Your USP

There’s one final component you should keep in mind—your unique selling proposition or USP.

TechTarget defines a USP as “a factor that differentiates a product from its competitors, such as the lowest cost, the highest quality, or the first-ever product of its kind.”

In other words, it’s what your product offers that your competitors’ product can’t.

And it heavily influences how much you can charge.

If there’s nothing especially interesting about your e-commerce brand or the product you’re selling, then you’ll probably want to aim for a similar or lower price point than your main competitors.

However, if you have an interesting USP and something that clearly distinguishes your brand from competitors, then you may be able to charge more and feel confident that people will still buy.

For example, Death Wish Coffee’s USP is that it’s “the world’s strongest coffee.”

Their site also explains that they only use premium, bold beans, and their coffee is 100 percent natural.

That’s part of why they can justify charging $19.99, whereas more generic brands are charing around $12–$15 for a bag of coffee.

So if you have a strong USP, it’s definitely something you’ll want to use to your advantage.

Step 6. Calculate Your Price

Once you know what your total per-product price is and how big of a margin you want, you’ll want to use this formula to calculate your price:

(Cost per product) / (1 – desired profit margin as a decimal)

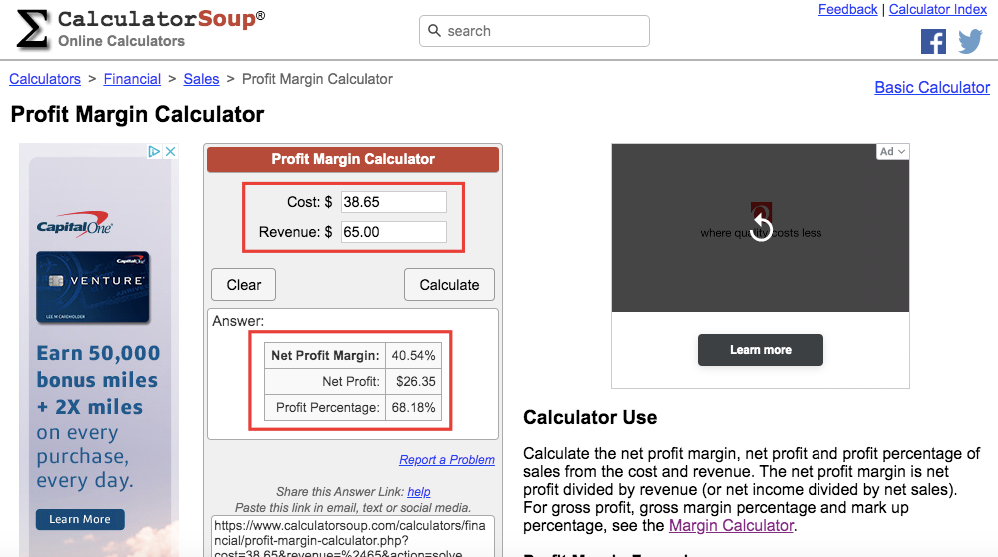

So if the cost per product was $38.65, and your desired profit margin was 40 percent, it would break down as follows:

($38.65) / (1 – .4) = $64.42

Round up, and it would come out to $65.

Of course, you may want to adjust that number when you consider how much your competitors are charging and what your USP is.

For instance, if that’s far beyond what your average competitors are charging, you may want to come down on your pricing.

Or if you have an amazing USP that no one else can offer, you may want to go up on it.

I also suggest using Calculator Soup, which is a free tool that lets you quickly see what your net profit margin, net profit, and profit percentage are.

Plug in the cost and the revenue you want, and it will calculate the rest.

Step 7. Test and Tweak Your Pricing

I have one final point to make here.

It’s important to remember that your pricing isn’t and shouldn’t be set in stone.

You can always tweak it later on as you gain more information and see how a product performs at a particular price point.

So with that in mind, don’t let the fear of choosing the wrong price stop you.

Whenever you’re iterating your pricing, there are two critical pieces of data you should examine.

The first is your sales figures.

Say that after setting your initial price to $65, you had massive sales, and it was hard keeping up with consumer demand.

There’s a good chance you could raise the pricing slightly to $70 and still be successful.

After all, if people are that eager to buy from you, a good portion will be willing to spend $5 more.

However, if sales were sluggish after setting your initial price at $65, it means you may be overcharging.

In that case, it would probably make sense to lower is to $60 and see if there’s a better response.

The second key piece of data you’ll want to look at is actual customer feedback.

If you get an overwhelmingly favorable response and receive a ton of positive comments about a product, then you’ve likely chosen a good price point, and there may be the potential to increase it.

Here’s an example.

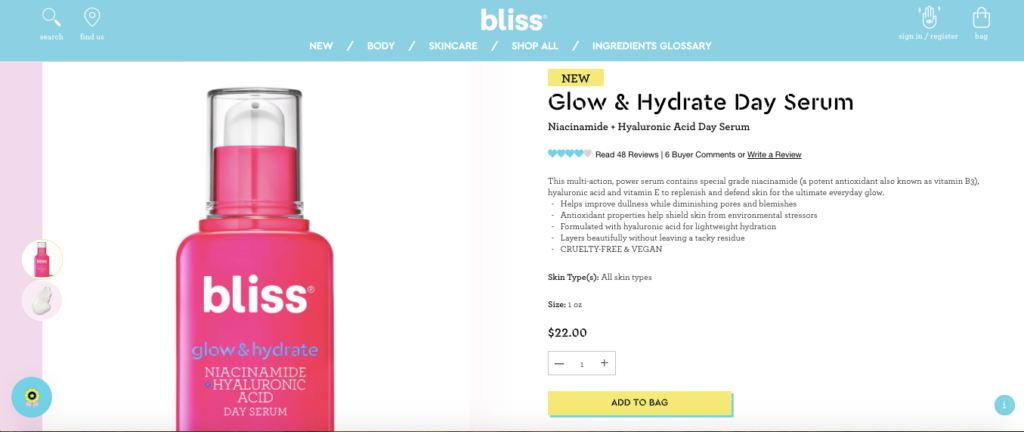

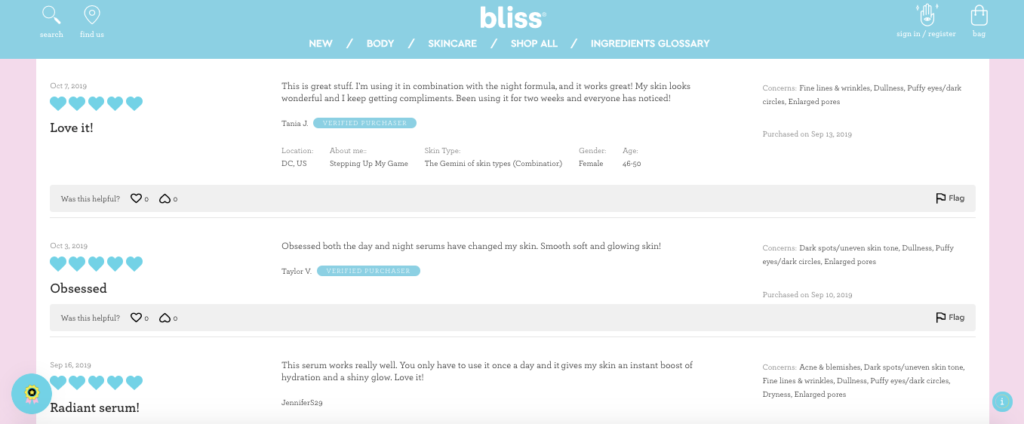

Body skincare company Bliss has a product called the Glow & Hydrate Day Serum, and it received some fantastic customer testimonials in the review section.

Check out how much their customers liked the product.

In this instance, it would probably be possible to increase the price slightly.

While you don’t want to get greedy and jack up your prices so much that you create friction with customers or kill the potential for repeat sales, this shows that you may be able to charge a bit more.

Just use your best judgment.

Conclusion

Knowing how to price a product correctly plays a vital role in your ability to convert leads and make sales.

It’s not rocket science, but there are several steps you must take in order to come up with a price that’s realistic and allows you to be competitive, while at the same time maximizing your revenue.

It starts with the basics of calculating your per-product cost and figuring out how big you want your profit margin to be.

From there, you should take into consideration how much key competitors are charging and how much leverage your USP gives you.

And as I mentioned earlier, you shouldn’t approach your product’s price as being a fixed number that can’t be changed.

In fact, there’s a good chance you’ll want to change it periodically as you unearth more information and competitors adjust their prices.

At the end of the day, following this formula should help you fine-tune your product pricing and be a legitimate contender in your industry.